As of this writing, 30M people in the U.S. are unemployed, a global pandemic has killed 784K people worldwide, and the murder of George Floyd has led to a global uprising of protests and activism directed at ending police violence against black people. So it would be fair to ask, “why should I care what happens to technology startups?”

To put it simply, startups have been the primary driver of job growth in the new economy. Over the past decade since the last recession, private companies in the U.S. less than one year old added an average of +1.6M jobs per year to the economy, while companies more than one year old lost an average of 634K jobs per year 1:

Startups fail, and the economy is expected to be volatile, but it is safe to assume that new ventures are going to be a vital factor in job creation over the next decade. That said, the types of startups that get funded, the number of deals and amount of funding, and the role of the various stakeholders (VCs, founders, boards, the government) will likely undergo significant changes in immediate and long term future.

Here are 9 predictions for what to expect in the post COVID-19 era:

1. Decline in new funding, funding amounts, valuations

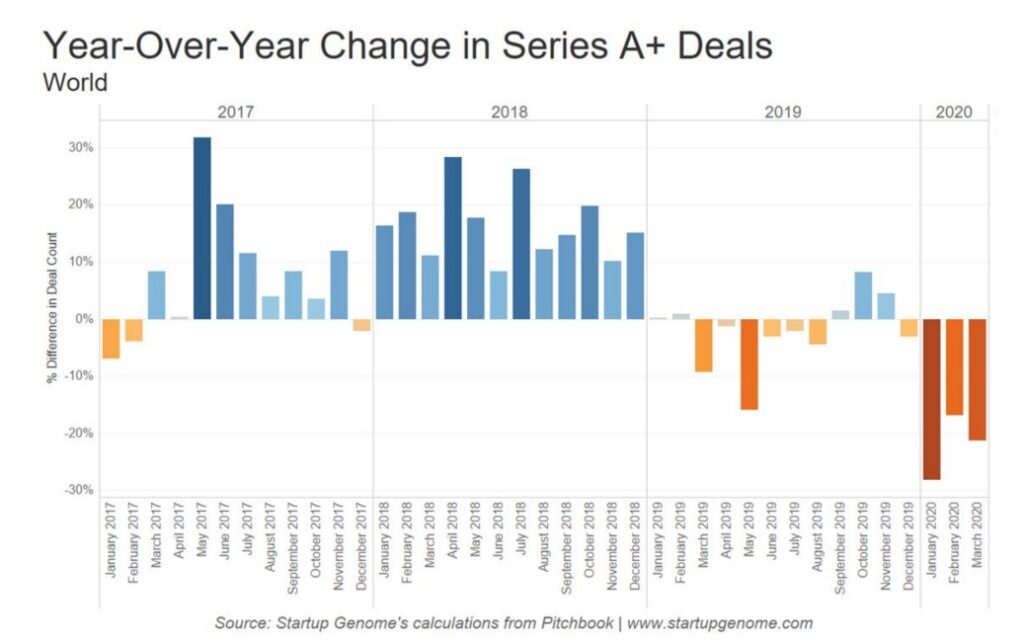

Not surprisingly, there has already been a decline in new venture capital (VC) funding for global startups. San Francisco-based analytics firm Startup Genome’s latest report on global startup funding indicates that funding has fallen by close to 20% since December 2019. China has had the largest impact, with funding falling by 50% in January and February compared to the rest of the world. Note that series A+ deals were already down YoY in 2019 compared to 2018 and 2017, which may add to the “funding crisis”.

Startup funding amounts (i.e., deal size) and valuations are expected to decline as well. And new funding is likely to be more focused on mid to later stage “winners” that are attractively repriced (i.e., valuation haircut). The reasons for this are pretty clear:

- Uncertain timing of COVID-19 recovery – large scale efforts are underway, but nobody can predict the exact timing 0f when a vaccine and/or reliable treatment will be available

- Rising cost of capital – as risk and uncertainty increases, borrowing costs will be higher and leverage ratios will increase

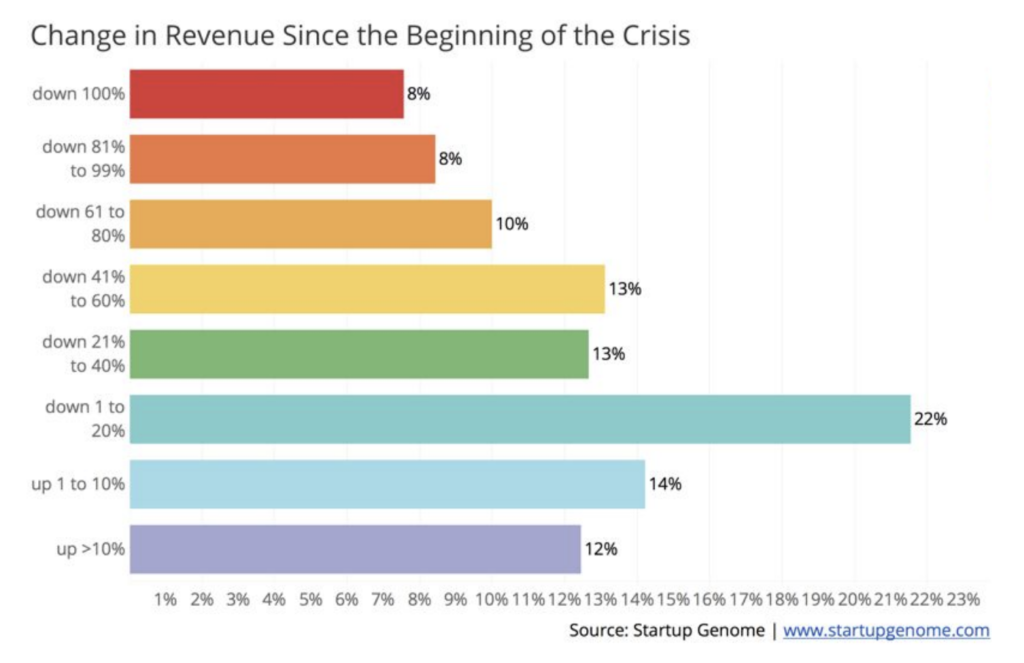

- Significant decline in demand – since the beginning of the crisis 74% of startups have seen their revenue decline and 16% have seen their revenue drop by more than 80% according to an April survey by Startup Genome on the Impact of COVID-192

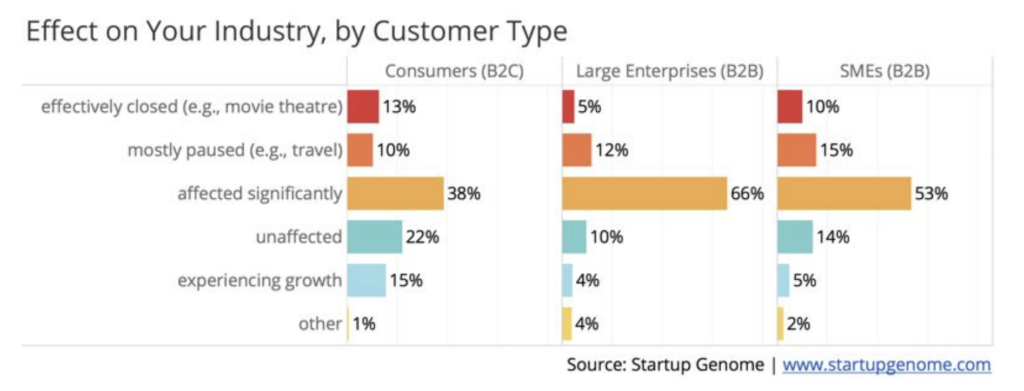

2. Broad effect, with larger impact on B2B

Not surprisingly, COVID-19 has had a broad impact on startups given the economic shutdown and general uncertainty. Startup Genome’s survey indicated that three out of four startups operate in industries severely affected by the COVID-19 crisis. The impact has been greater for B2B large enterprise and SMEs versus B2C.

On a positive note, one out of ten startups have experienced revenue growth, with 12% of startups experiencing over 10% revenue growth since the beginning of the crisis. B2C startups are three times more likely to be in industries experiencing revenue growth vs. B2B startups. This seems to be a factor of people staying home, and shifting their spending patterns to online purchasing, which favors tech startups vs. traditional companies. Also, the B2B results may indicate that enterprise companies have significantly cut spending on “big ticket” items like enterprise software subscriptions.

3. Certain industries hit hard, with a long recovery

This one is a no-brainer, but certain industries such as travel and entertainment have been hit particularly hard, and will experience a long recovery. Even after an effective vaccine is available, it will likely take some time for people to feel comfortable getting on an airplane or being part of a large crowd at a concert. After 9/11, it took nearly 3 years, until July 2004, for the airline industry to match and finally surpass pre 9/11 levels according to U.S. Bureau of Transportation statistics.

On a positive note, Millennials and Gen Z have transformed the economy to focus more on experiences, so the recovery time for the travel and entertainment industries may be shorter if these generations lead the return to pre-COVID demand and behaviors. According to a study conducted by Expedia and the Center for Generational Kinetics, 74 percent of Americans now prioritize experiences over products or things, largely due to the influence of Millennials and Gen Z.

4. Survival mode – cutting costs, reducing cash burn rate

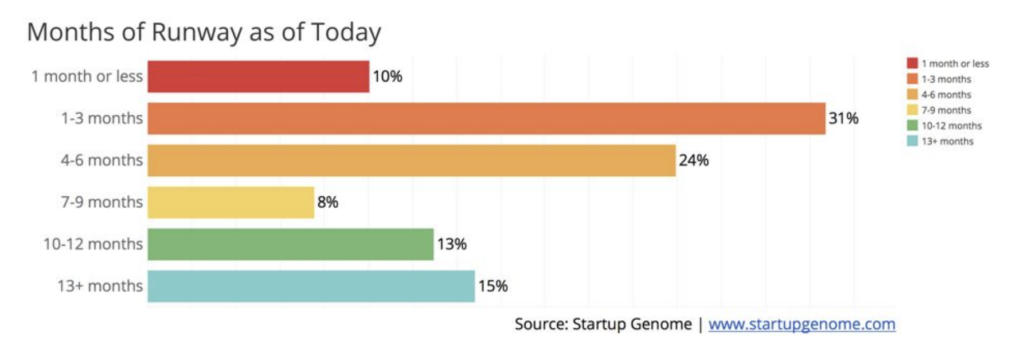

According to CB Insights, 29% of startups fail because they run out of cash. The industry standard for ideal cash runway to maintain between fundraising rounds to is 12-18 months. Of course, this is in “normal” times. It would have been hard for startups to predict and prepare for a global pandemic of this magnitude.

The situation is urgent. According to Startup Genome’s April Survey, an astonishing 41% of startups are currently in the “red zone”, i.e., they have three months or less of cash runway left.

So not surprisingly, most startups are scrambling to cut costs and preserve cash. According to the Startup Genome survey, two thirds of startups have reduced their expenses with 42% cutting costs by more than 20%. Despite cost cutting efforts, it seems clear that many startups are going to need urgent investment or aid from the government to survive.

5. VCs and boards will be more involved than ever

Board members have “fiduciary duties”, meaning, as stewards of public trust, board members must always act for the good of the organization, rather than for the benefit of themselves. They need to exercise reasonable care in all decision making, without placing the organization under unnecessary risk.

Fiduciary duties mean that board members have a duty to reduce the risk of the various stakeholders, which in the post COVID-19 era, likely means a more active role in cutting costs, preserving cash, and ensuring the survival of the company. Tech startups have already had significant layoffs, and the role of VCs and boards in these difficult decisions can’t be underestimated.

The dream of relatively hands off investment appears to be on hold for now. For example, it seems less likely that a startup founder will be able to bring on a new investor as a “board observer” versus a full board member with voting rights.

6. Governments will intervene and bail out startups

Given that startups fuel the majority of new job growth (see above), global governments will intervene and take a more active role in supporting or bailing out startups than they ever have before.

This is already happening. The U.K. government launched a $1.6 billion rescue package for tech start-ups hit by the coronavirus outbreak in April. The rescue package includes an innovative co-investment model that other countries may choose to adopt. In this £500 million “Future Fund” for high-growth start-ups, loans will automatically convert to equity in a start-up’s next funding round, or at the end of the loan if the debt hasn’t been repaid. The government will commit an initial £250 million, while the private sector is expected to make up the other half.

In the U.S., some startups have already taken advantage of Small Business Administration (SBA) programs like the Paycheck Protection Program (PPP), a loan program that startups can apply for to avoid layoffs that provides protection for up to $10M in payroll. There has been quite a bit of discussion around the ethical and moral dilemma of a VC-funded Silicon Valley startup taking government loans that could have been used by a neighborhood coffee shop or florist.

7. A shorter path to profitability

Amazon launched on July 16, 1995 and finally announced a modest $5M profit on January 30, 2002. The gold standard approach for startups has been hyper growth mode, or investing in top line revenue growth for as long as possible before worrying about profitability.

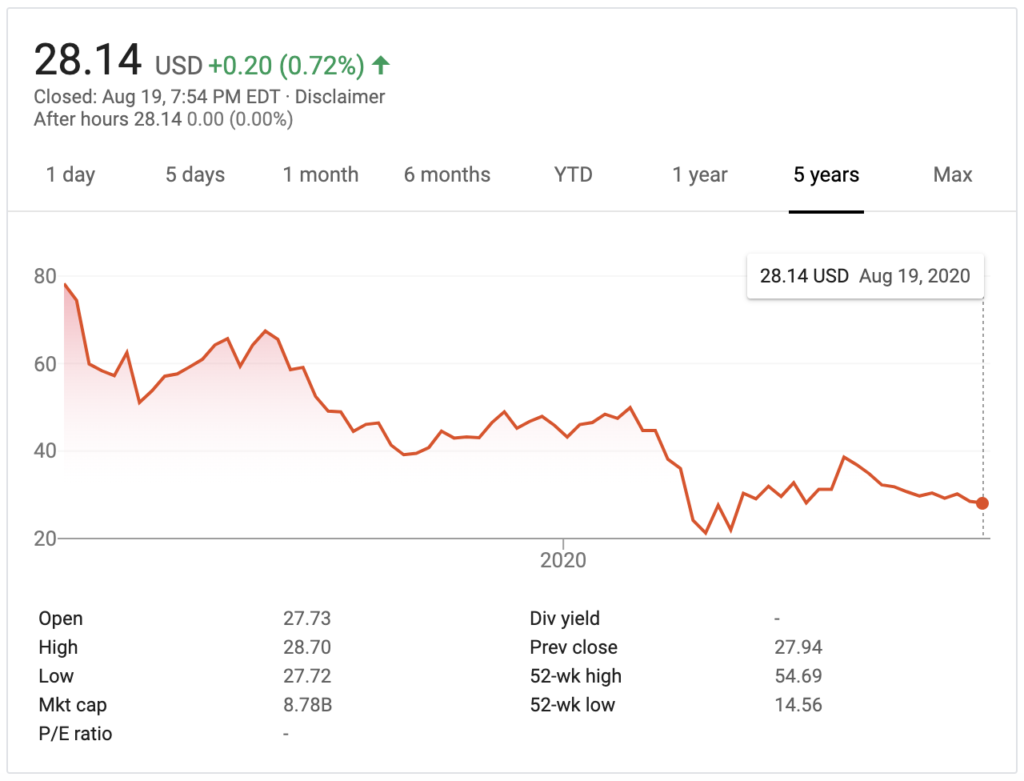

Before COVID-19 hit, the startup world was already shaken by the bottom falling out on large-scale pre-IPO darlings such as WeWork and Lyft. At one point WeWork ran up a $47B valuation, but was losing $219,000 per hour. Lyft’s IPO was initially priced at $72 per share. Its stock has recovered slightly since a sharp post-COVID decline in March, but the current price of $28.14 a share is less than half of its IPO price, indicating that Wall Street is skeptical of Lyft’s path to profitability and long term prospects. Lyft’s net losses were $398M in Q1 2020.

It seems clear that post COVID-19, VCs will invest in ideas that have stronger unit economics, stronger and more defensible business models, and the possibility of a true “moat” including brand, favorable cost structure or an unfair advantage such as IP-protected technology. How much shorter will a startup’s expected path to profitability need to be? That remains to be seen, but it seems unlikely that VCs will be lining up to invest in a startup like WeWork that is not even close to turning a profit after 10 years of existence.

8. A shift back to self-serve first model startups

Technology enabled services has been a major trend of VC investment for the past few years. The basic idea is to empower service providers with software and automation to make them more operationally efficient and allow them to serve more customers. Part of the promise has been to unlock heavily regulated industries such as healthcare and legal services.

Before COVID-19 hit, tech-enabled services startups were already having mixed results. Legal automation and a16z portfolio company Atrium shut down on March 3rd, laying off all 100 employees and returning some of its $75M in funding to investors.

I believe there will be a more conservative approach to the types of startups that get funded for the immediate future. VCs will shy away from the higher cost structure and unit economics of “tech enabled services” startups. SaaS products that are built for a self-serve first approach will be favored. Let’s not forget that some of the most successful tech companies of all time were built self-serve first. For example, Google’s primary revenue-generating product AdWords (now Google Ads) was built as a self-serve first product that was easily accessible to SMBs. Google later added Sales and even enterprise Sales, but the product was built for easy signup -> onboarding -> activation (build your first campaign, input a daily budget, and launch).

9. Healthcare, collaboration, delivery will get funded

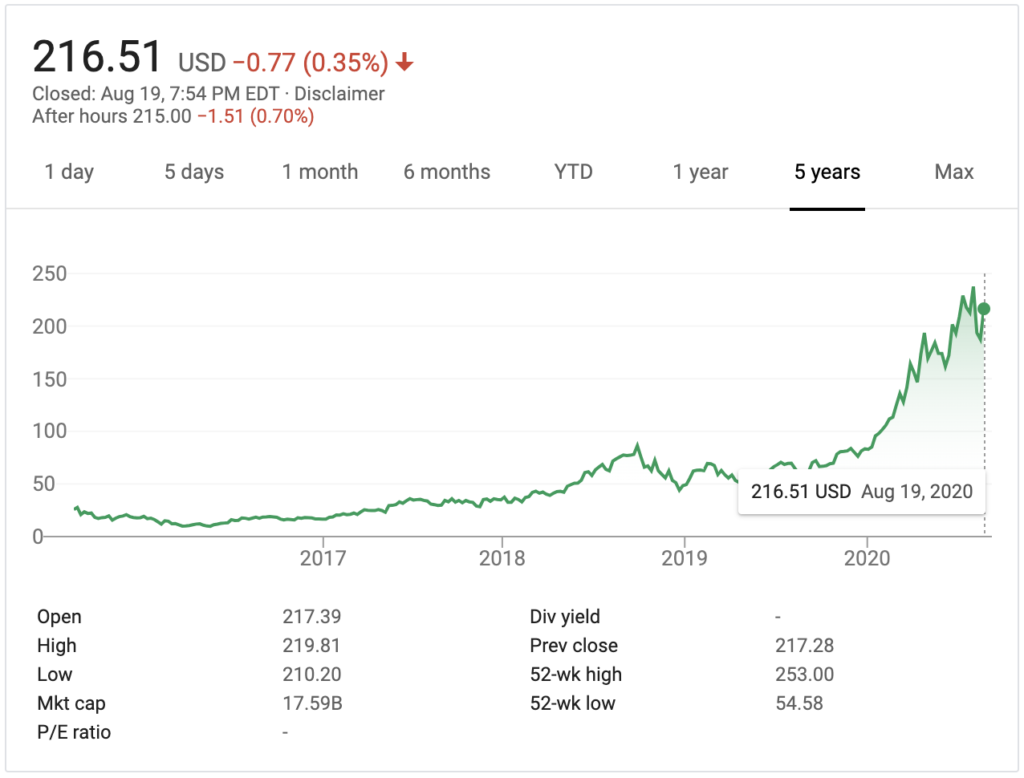

No brainer, startups in a few specific industries and/or types of products will more easily get funded in the post COVID-19 era. Healthcare startups, especially those that enable telemedicine or other remote services will make for easy investments. The incredible growth that Teledoc Health saw before COVID-19, and surge since the pandemic hit, is an example to investors. Teledoc Health is trading at $217 per share today, up +1,042% from its initial IPO price per share of $19 in 2015.

Zoom has become a verb since COVID-19 hit, the ultimate sign of broad technology adoption. There is likely still room for a host of new products and innovations in remote SaaS products for collaboration, e.g., MURAL is a collaborative digital whiteboard product that has caught on. And it seems likely that even after life gets back to “normal”, more people will use delivery services like DoorDash and Instacart given that they had a positive experience and adopted the behavior during COVID-19 lockdown. Investors will fund startups that provide tech-enabled delivery services when the unit economics make sense and the approach is innovative.

Conclusion

Startups matter. You should care about what happens to startups as a result of COVID-19 because startups are the primary driver of job creation in the global economy. In the U.S. alone, companies less than one year old added an average of +1.6M jobs per year to the economy since 2011.

So what’s next? Let’s not sugar coat it, there is quite a bit of bad news. Global startups have already seen a decline in new funding, funding amounts, and valuations. Startups in certain industries (e.g., Travel and Entertainment) and B2B startups have been hit the hardest. Many startups are in “survival mode”, urgently cutting costs, reducing cash burn rate to try to make it to the other side. VCs and board members will be more hands on than ever before, which some founders may not like.

That said, there is also good news that will help startup founders see the light at the end of the tunnel, and even find opportunity in the crisis. Many B2C startups have actually seen revenue growth during the crisis. Governments have stepped in to support tech startups more than ever during the crisis, e.g., the U.K. government’s $1.6B rescue package. 74% of Americans now prioritize experiences over products or things due to the influence of Millenials and Gen Z, so the demand for travel and other experiences may come back faster than it did after previous crises like 9/11.

While the COVID-19 crisis will likely place more scrutiny on a potential startup’s path to profitability, investors will love more practical self-serve first business models that have favorable unit economics and LTV:CAC ratios versus those with a sales-assisted marketing process. And there are likely many more opportunities for startup founders to innovate in specific areas such as healthcare and telemedicine, collaboration tools, and tech-enabled delivery services.

Many of life’s failures are people who did not realize how close they were to success when they gave up.

Thomas Edison

I believe that startups growth = curiosity + persistence. The ability of startup founders and teams to persevere is going to be pushed to the limit following COVID-19. The call is out to everyone in the tech startups community: How are you going to rise to the challenge? How will you find clever work-arounds to urgent problems? You just might find opportunities to not only survive, but thrive and build companies that can help the world emerge from this crisis better off than before.

- United States Bureau of Labor Statistics. (2020). Table 1-A-E: Annual gross job gains and gross job losses by age and average size of establishment [Data file]. Retrieved from https://www.bls.gov/bdm/business-employment-dynamics-data-by-age-and-size.htm

- The Impact of COVID-19 on Global Startup Ecosystems: Global Startup Survey. (2020). Report [Presentation file]. Retrieved from https://startupgenome.com/reports/impact-covid19-global-startup-ecosystems-startup-survey